The European Patent Office (EPO) and International Energy Agency (IEA) recently published an analysis of global innovation along hydrogen value chains.

Hydrogen is viewed as a key enabler in achieving net-zero carbon emission targets and the report considers technical areas along the hydrogen value chain, from production, through storage, distribution and transformation, to end use applications across many different industries.

The report uses published international patent families (IPFs) between 2001 and 2020 as a metric to measure patenting activities in these different areas of hydrogen related technologies (although much of the analysis is focused on the 2011-2020 timeframe). The filing of an international patent application typically reflects a development which is considered valuable to the applicant.

In the following we overview the contents of the report from both geographic and technology perspectives and also highlight the report’s significant finding on how patenting by hydrogen related start-ups leads to higher levels of fundraising, particularly in attracting later-stage investment.

Patents and funding

The report notes that start-ups provide one of the main routes by which hydrogen innovations reach the marketplace. Further, many of these innovations are dependent on scientific advances originating in universities and public research institutions. Since 2000 the number of start-ups in the hydrogen space has grown consistently and many owned patents at the time they were incorporated. The report estimates that 70% of start-ups in the hydrogen space hold patents.

The report further considers that given the long development timescales in bringing hydrogen technologies to market (the average age of hydrogen start-ups raising later stage funding being about 10 years) patents can play an important role in securing investment and providing investors with increased confidence in the technology and competitive advantage.

This is evidenced when considering venture capital deals involving hydrogen start-ups, the report indicating that the share of the total amount of funding raised by companies with patent applications grows when moving to later fundraising stages. 80% of later stage funding went to companies that held patents, and this grew to 95% when considering IPO/Post-IPO stage funding.

Geographic distribution of hydrogen patents

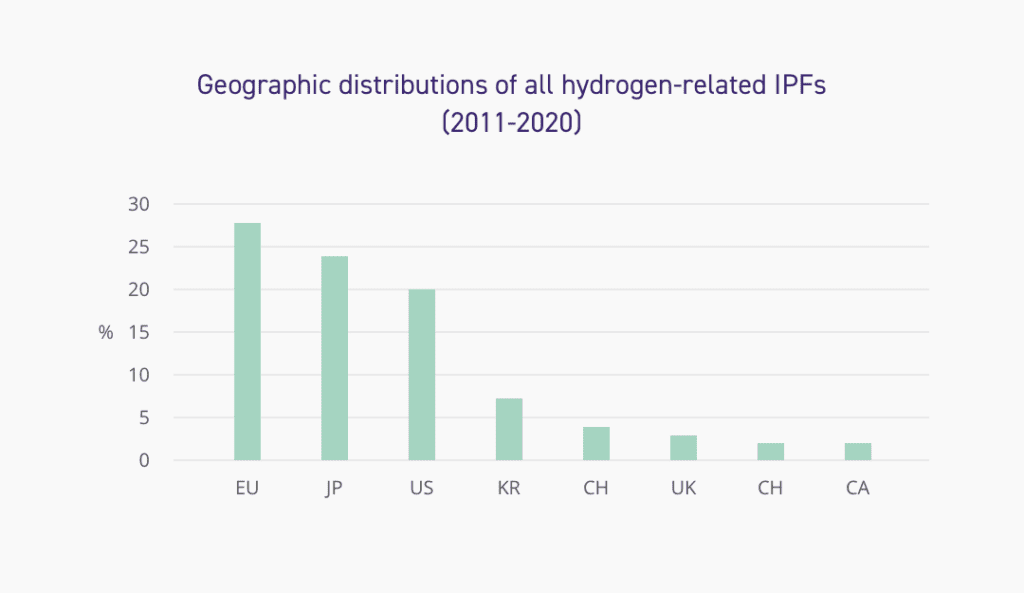

The below Figure illustrates the distribution, based on geographic region of the applicant, of all hydrogen related IPFs in the 2011-2020 timeframe. Europe, Japan, and the United States, and to a lesser extent South Korea, dominate the global patent space for hydrogen related technologies. During this period these regions accounted for 79% of all IPFs published. Europe and Japan both demonstrated sustained growth in hydrogen patenting between 2001 and 2020, with Europe recently taking the largest share of IPFs from Japan. However, this may be short lived, as Japan has shown faster average annual growth in recent years (2016-2020).

The report indicates that the patent filing rate in Europe between 2001 and 2020 was driven by the European chemical industry via innovations in established technologies. However, there has also been a notable shift towards electrolysis and fuel cell technologies. Top applicants in emerging technologies are driven by Japan and Korea, primarily due to their automotive industries. China and Korea show moderate patent growth, but are starting to emerge as key countries internationally. However, the United States shows a surprising decrease in hydrogen related patenting since peaking in 2014.

The location of start-up companies who own hydrogen IPFs is of note. Based on analysis of 117 start-ups identified by the report, the majority were based in the US (33%) and Europe (51%). Although Japan has a high level of patenting in the hydrogen space, almost no start-ups were identified, highlighting how established companies are driving hydrogen patenting in this region.

Australia is not mentioned in the report in relation to the number of IPFs published, which suggests that patent numbers from Australia contribute to less than 2% of IPFs over this period. Australia does however receive mention in relation to the promised increase in electrolyser capacity by the Australian government, which is expected to be online by 2030. It hopes to implement approximately 35 GW of total capacity, the largest of any single country and the second largest of any region. This is particularly interesting in view of Australia’s critical minerals strategy, which we have recently discussed here, as all of the minerals required for current electrolyser technologies are available in Australia. With the focus of the critical minerals strategy towards downstream production and manufacturing capacity in the clean technology space, it is likely we will see a future increase in Australian patent filings, given the government’s commitments and access to resources.

Technology areas

Hydrogen production

Half of all IPFs published between 2011 and 2020 relate to the production of hydrogen. Although present hydrogen production remains almost entirely fossil fuel based, nearly 80% of patent families during this period were motived by climate factors. IPFs related to the production of hydrogen from fossil fuels, biomass or waste streams were down after peaking between 2007 and 2011. Unsurprisingly, patents related to hydrogen produced by electrolysis have rapidly grown, with over 500 IPFs published in 2020 and up from less than 100 in 2002.

Japan has focused on innovation in state-of-the-art alkaline electrolysers and cutting-edge polymer electrolyte membrane (PEM) electrolysers. Conversely, patenting in Europe is active in solid oxide electrolyser cell (SOEC) technologies, which includes their manufacture. Europe is also making contributions to PEM and alkaline electrolyser technologies, suggesting that they expect all of these technologies to play a role in future hydrogen production.

The United States shows high patent activity in the manufacture of PEM electrolysers, and, not surprisingly, China is heavily focussed on electrolyser manufacturing, but the focus has been towards cheaper established alkaline technologies, which are expected to see fewer improvements in the future.

Hydrogen storage, distribution and transformation

Established technologies have attracted the most innovation in this space over the last two decades. There has been a clear decrease in momentum for patenting technologies directed towards storage using hydrogen based fuels (synthetic methane, diesel or kerosene) and solid hydrogen storage technologies (hydride storage and adsorption).

Patents directed to hydrogen storage in liquid organic hydrogen carriers (LOHC) and ammonia cracking have rapidly increased between 2011 and 2020, with average annual growth rates of 12.5% and 7.8% respectively. Japan has a considerable specialisation in ammonia cracking with 61% of the published IPFs over this period. IPFs directed to LOHC technologies are dominated by Europe, with 49% of published IPFs, and patenting directed towards the production of methanol and ammonia have also grown steadily between 2001 and 2020.

End-use applications

End-use applications of hydrogen are dominated by patenting from the automotive sector, expanding at a far higher rate than other sectors. Applications of hydrogen that have seen an increase in innovation over the last few years are the production of ammonia and methanol, chiefly driven by Europe with 7 of the top 10 applicants in this space.

Patenting in iron and steel production has also recently increased, but has yet to match the large increase in patent filing numbers emerging from the automotive industry.

Finally, other applications, such as long-distance transportation (shipping and rail), power generation and the use of hydrogen in buildings have not yet shown an increase in patent filings, in fact power generation and the use of hydrogen in buildings have both shown decreasing patenting rates, perhaps reflecting a growing interest in battery technology as an alternative for stationary energy storage.

How can FPA assist?

Aside from examining recent geographical and technological patenting trends in the hydrogen space, the report’s analysis of hydrogen start-ups and the relationship between patenting and funding is significant. Establishing a strong initial patent position at the beginning of a business journey is critical and can serve to underpin business value and attract investment.

As the report clearly illustrates, the hydrogen value chain encompasses many aspects, and is enabled by a wide range of technical disciplines. FPA Patent Attorneys have the technical expertise to support both start-ups and established companies in creating and growing their patent portfolios in what will undoubtedly be an increasingly complex and competitive field.