The Australian government recently published a discussion paper on the country’s Critical Minerals Strategy. The paper examines the role of critical minerals in supporting clean energy technologies and considers how Australia might capture global clean energy opportunities by expanding the critical minerals sector into downstream processing.

Australia has some of the world’s highest reserves of critical minerals which underpin the development of clean energy technologies. These minerals are of vital importance in meeting zero-carbon emission targets. Globally, Australia ranks 1st in lithium production (producing almost half of the world’s supply) and from 1st to 4th in the production of cobalt, manganese and rare earths. Australia already produces nine of the ten minerals used in current lithium-ion battery anodes and cathodes, with plans to develop facilities to manufacture the tenth (graphite).

Historically, a majority of these minerals have been exported, however a commitment of the Critical Mineral’s Strategy is to expand current mineral production into downstream capabilities, including the development of battery precursor materials. This is viewed as a value add opportunity through implementing advanced processing and manufacturing within Australia, potentially strengthening the country’s supply chain resilience and reducing dependency on technology importation from overseas.

One interesting aspect of the discussion paper considers how to best develop and retain domestic intellectual property (IP), and also attract investment in IP, including from overseas. In this regard the government is considering what role it could play in fostering links between national science agencies, industry and academia to advance mineral processing capabilities and create world leading IP. Part of this initiative considers how Australia’s critical minerals industry can be supported to move further downstream and develop new capabilities.

Historically, from a domestic perspective, while Australia has pockets of downstream processing development leading to patent activity, it is a small player in the relevant technology fields compared to major trading partners.

Australian originating international patent applications

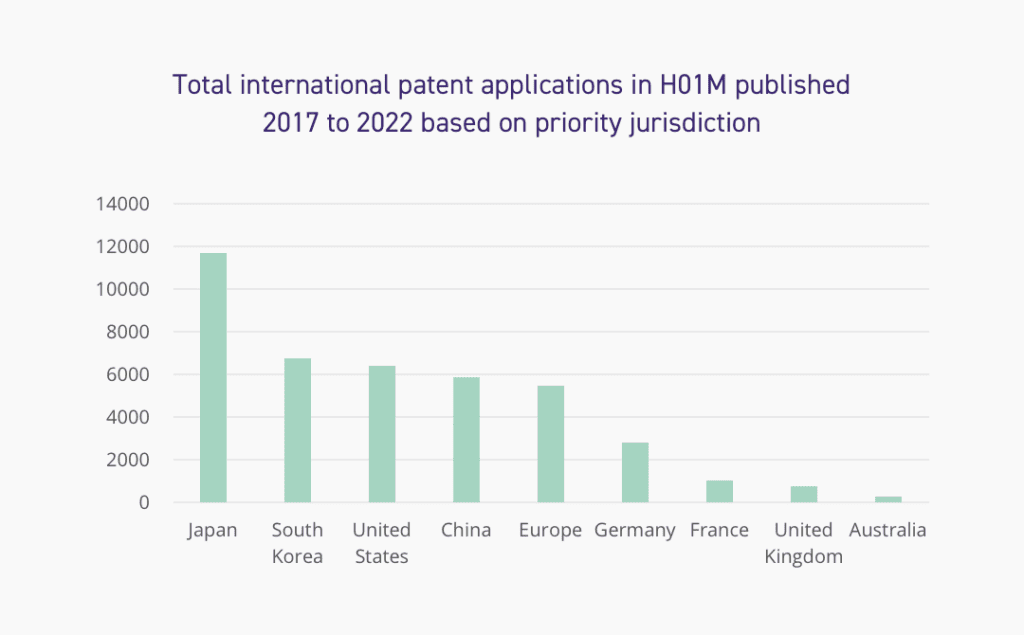

One relatively simple metric which illustrates this point is the number of international patent filings in patent class H01M (Processes or means, e.g. batteries, for the direct conversion of chemical energy into electrical energy).

This patent class includes secondary cells, encompassing aspects of developments that may be considered as representing value add technologies flowing from critical mineral downstream processing. Figure 1 compares the total number of international patent application publications over the six year period from 2017 to 2022 and which have at least one priority filing associated with a particular jurisdiction. For the purposes of this analysis priority jurisdiction is regarded as a fair proxy for the invention having originated in that jurisdiction.

Figure 1 indicates that the number of Australian originating international patent applications is relatively low compared to those originating from major trading partners.

Australian patent applications

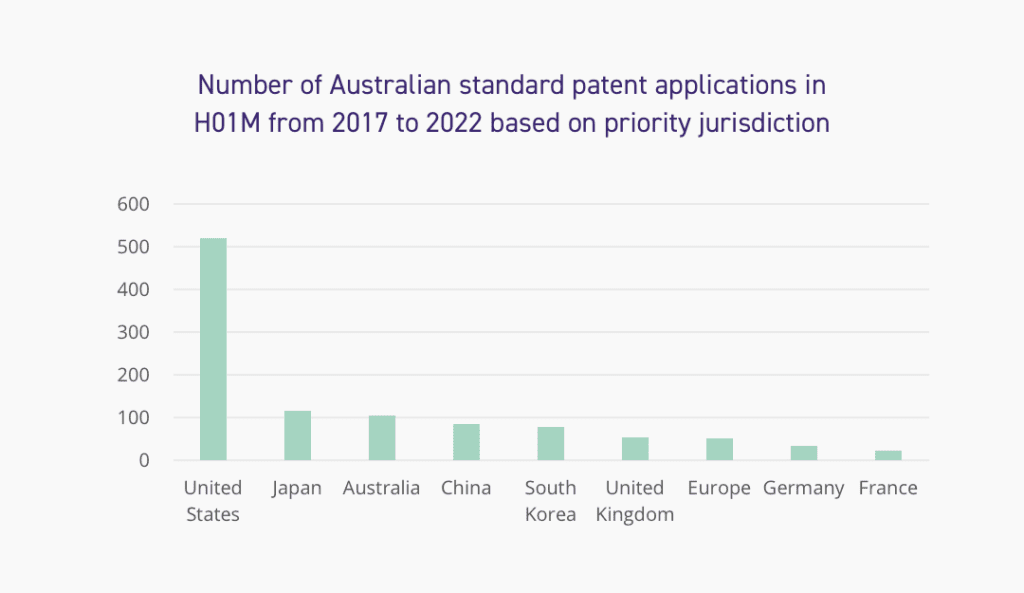

Another useful metric is the total number of Australian patent applications filed in the H01M patent class.

Figure 2 illustrates the total number of Australian standard patent filings over the six year period from 2017 to 2022 based on jurisdiction of origin, again utilising priority jurisdiction as a proxy for an invention having originated in that jurisdiction.

Not surprisingly, Australia fairs better in this metric, likely due to local entities prioritising protection of their innovations in the local market. What is more notable though is the relatively low numbers of patent applications originating from overseas jurisdictions, with the exception of the United States.

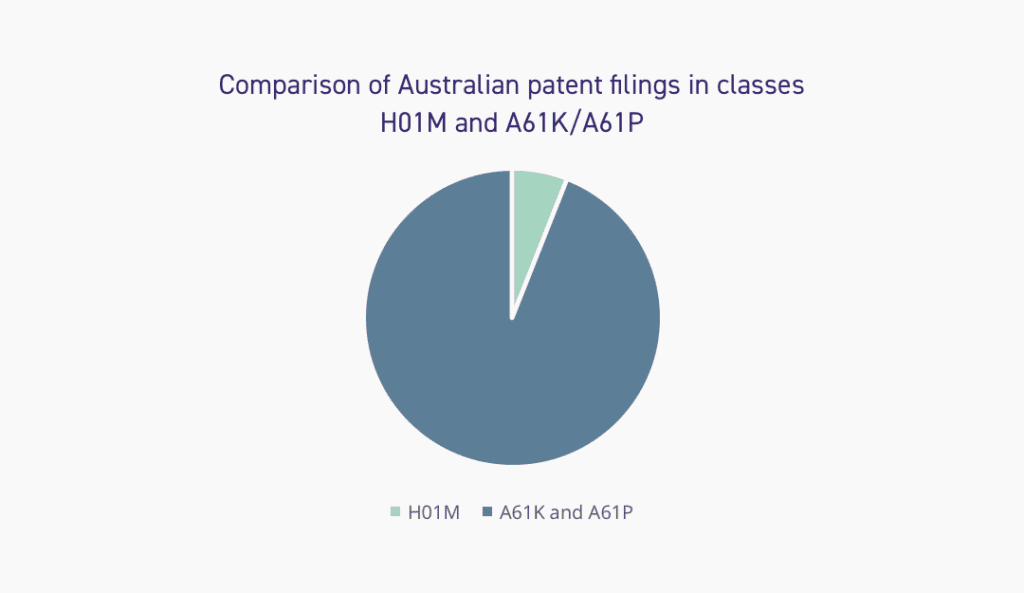

Further insight can be gleaned by comparing the number of Australian patent applications in class H01M with those in classes A61K and A61P. These latter classes encompass “preparations for medical, dental or toilet purposes” and “specific therapeutic activity of chemical compounds or medicinal preparations”, which are a fair proxy for inventions in the pharmaceutical and biotechnology fields.

The total number of Australian standard patents filed over the six year period in patent class H01M was approximately 1200, of which 80% originated from the United States, Japan, China, South Korea and the European jurisdictions indicated in Figure 2. In contrast, the total number of applications filed in classes A61K and A61P was almost 19,000, of which 85% originated from these same jurisdictions. Figure 3 graphically illustrates the difference in filing numbers.

From a global perspective, Australia has always been an attractive jurisdiction for patent filings in the pharmaceutical and biotechnology sectors, however the approximately 15 fold gap between filings in this sector and those in class H01M over the past six years is stark.

Possible implications for Australian patent activity

The results of the present analysis indicate that historic patent activity in Australia both from a domestic and overseas perspective in respect of one aspect of downstream mineral processing technology has been modest. In view of the criticality of battery technologies in addressing net zero carbon emission targets and ongoing geopolitical energy supply issues this might seem surprising.

However, the relatively low levels of overseas originating patent filings into Australia in this sector are possibly in part due to a perceived lack of competition from an Australian based manufacturing sector.

If the government’s critical minerals strategy is successful then the levels of future domestic innovation will likely increase. Such increases in innovation should have a follow on positive effect on patent filings in the H01M class. It may also signal an increase in overseas originating patent filings as overseas entities seek to protect innovations in an increasingly competitive Australian market.

Mineral processing, and particularly downstream activities such as battery research and development, require expertise in a wide range of technical fields, ranging from fundamental chemistry and materials science to electrical and mechanical engineering.

The multidisciplinary team at FPA has technical expertise relevant to all aspects of the sector and can assist in identifying and protecting new developments, as well as advising on the potential impact of what is likely to be an expanding and increasingly complex Australian battery patent landscape.