In 2023, 8.3% of new cars sold in Australia were electric vehicles (EVs),1 a significant increase from 3.8% the year before.2 In April last year, the International Energy Authority predicted that global EV sales will reach 18% of all new cars by the end of 2023.3 We’re awaiting the final data for 2023 global EV sales.

Although steadily increasing, two issues hamper EV adoption. First, the range of consumer EVs is typically about half that of an internal combustion engine (ICE) equivalent. As an example, the range of a diesel-powered Mercedes-Benz E-220d is 1500 km, compared to 837 km for a Tesla Model S Plaid+. Second, the EV charging infrastructure is not yet as widely developed as petrol or diesel fuel.

Therefore, it is likely that ICE vehicles will continue to have an important role for the foreseeable future and there is therefore interest in alternative fuels to fill the gap between replacing ICE vehicles with EVs, or as a long term solution to the present shortfalls of EVs. This is particularly important in sectors such as commercial hauling, shipping, and aviation, where vehicle range is essential.

One potential fuel being discussed is ammonia (NH3), which is already the second most produced chemical globally due to its extensive use in fertilizer production.4 Car manufacturer Toyota has even recently announced that an ammonia engine they are developing (in collaboration with Chinese manufacture GAC Group) will be “the end of EVs”.5

Ammonia as a fuel

Ammonia as a fuel is not unknown. In 1943, 100 Belgian buses were adapted to run on ammonia in response to the diesel shortage of World War II.6 Ammonia’s energy density is also similar to that of methanol and approximately double that of liquid hydrogen, which themselves are touted as emerging alternative fuel sources.7

Compared to hydrogen, ammonia liquefies at a far higher temperature (about −33 °C for ammonia vs −253 °C for hydrogen) which means lower costs for storage and distribution. One downside is that ammonia is a known hazardous chemical and so safety precautions are required due to its causticity and toxicity. However, safety measures for other alternative fuels would also be required, as fuels such as hydrogen, methanol and ethanol are highly flammable. Furthermore, hydrogen is typically used to produce ammonia industrially and so ammonia could also be considered a storage medium for green hydrogen.

Ammonia production

Although there are developing ammonia production technologies, such as electrochemical production, non-thermal plasma synthesis, and enzyme-based synthesis,8 ammonia is produced predominantly through thermochemical means by the Haber-Bosch process (shown below):

H2 + 3N2 ⇌ 2NH3

∆H°= −91.8 kJ/mol

A large quantity of energy is needed for the Haber-Bosch process, and this is typically produced by burning fossil fuels. This is because the process requires high temperatures (400-500 °C) and pressures (150-300 bar) to facilitate an adequate rate of ammonia production. At present, roughly 90% of the hydrogen used for the Haber-Bosch process comes from fossil fuels by cracking natural gas.9 This means that ammonia production currently emits a large quantity of greenhouse gases and accounts for roughly 2% of global energy usage.

Understandably, given the increasing need to reduce fossil fuel emissions, ammonia (or specifically the hydrogen required) needs to be produced through alternative or carbon-free means. This clearly opens the door for considerable innovation in this space.

Patents

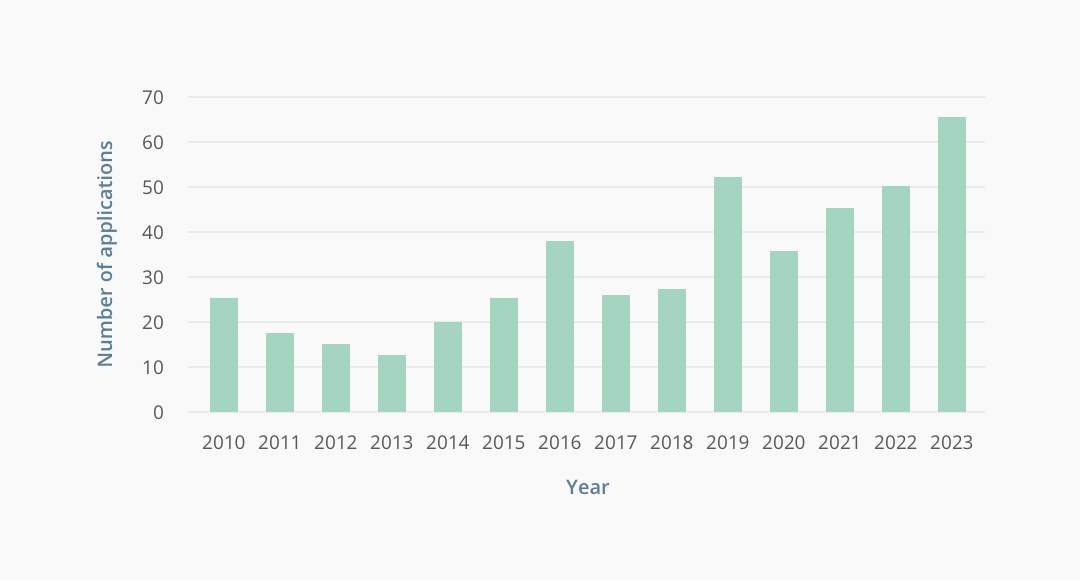

The developing patent landscape around ammonia production was examined by conducting a search of international patent application publications in the International Patent Classifications C01C 1/02 (preparation or separation of ammonia), C01C 1/04 (preparation of ammonia by synthesis), and C01C 1/08 (preparation of ammonia from nitrogenous organic substances) between 2010 and 2023. These classifications were used as an approximation for the total number of patent applications relating to ammonia production and the records subsequently reviewed to remove those related to the separation of ammonia only. The results are shown in Figure 1.

Figure 1. Number of international patent application publications between 2010 and 2023 related to ammonia production.

The results reveal moderate overall growth in the space, with patent applications filed per year roughly doubling between 2010 and 2023. This is in contrast to other “clean” technology areas, such as plastic recycling, battery recycling and lithium-ion batteries, which show far larger increases in patent application filings over the same period.

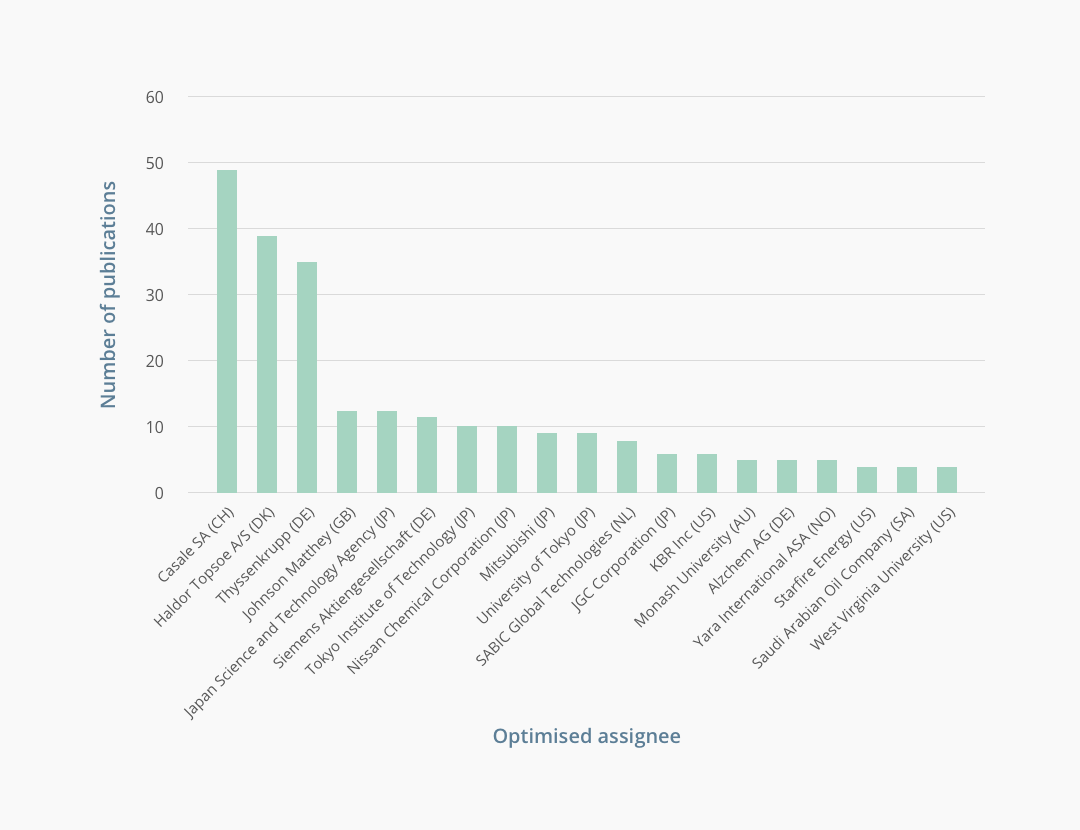

An analysis of the patent applicants/assignees with four or more international patent application filings (Figure 2) indicates four are university entities or research institutions (Japan Science and Technology Agency, Tokyo Institute of Technology, University of Tokyo, and Monash University), with the remaining predominantly from the chemical industry.

Figure 2. List of the optimised assignees with four or more international patent application publications relating to ammonia production between 2010 and 2023. Entities under one parent company are combined.

The top three patent filers are Casale SA, Haldor Topsoe A/S and Thyssenkrupp (and their subsidiaries), with 49, 39 and 35 filings respectively. This is considerably higher than any of the other applicants. It is unsurprising that applicants in chemical industry are among the top patent filers due to the current industrial importance of large scale ammonia production. Notably, among the top patent filers, Japanese based entities are the most represented. Pleasingly an Australian entity (Monash University) is also represented.

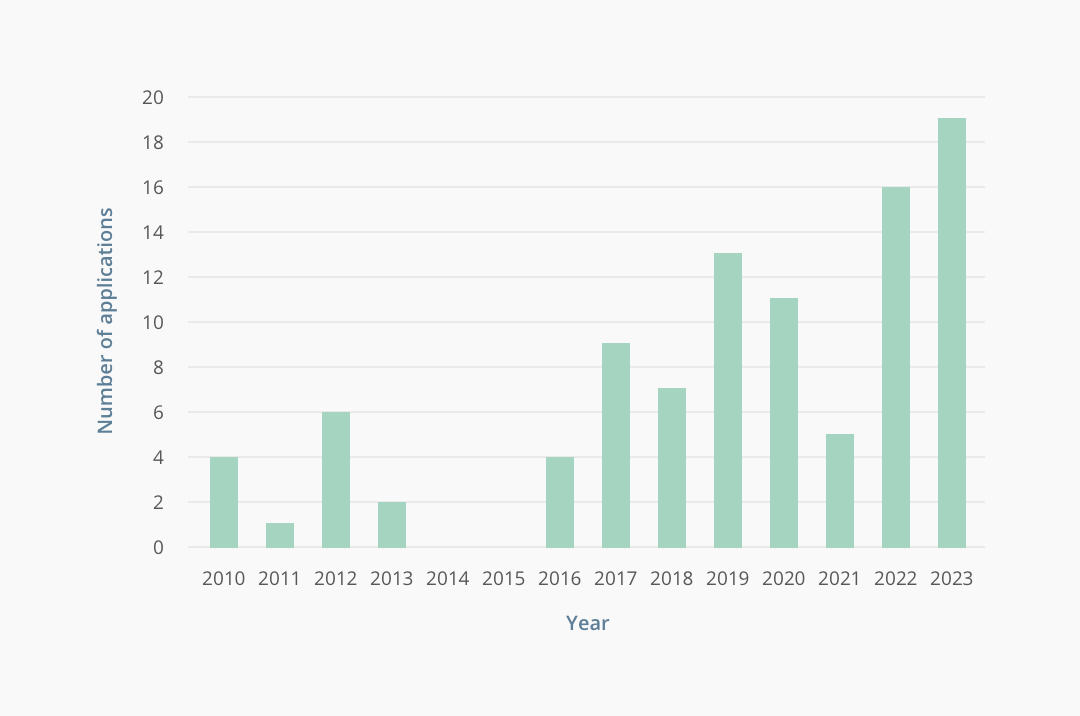

Turning our attention locally, Australia shows a more substantive increase in patent applications directed to ammonia production over this period when compared to the global trend (Figure 3). National phase entries into Australia in this technology space have risen from only 4 in 2010 to a peak of 19 in 2023 and show a notable increase across the 2016-2023 period (note that a national phase application date typically lags a corresponding international patent application publication date by about 1 year).

Figure 3. Number of national phase entries in Australia between 2010 and 2023 related to ammonia production.

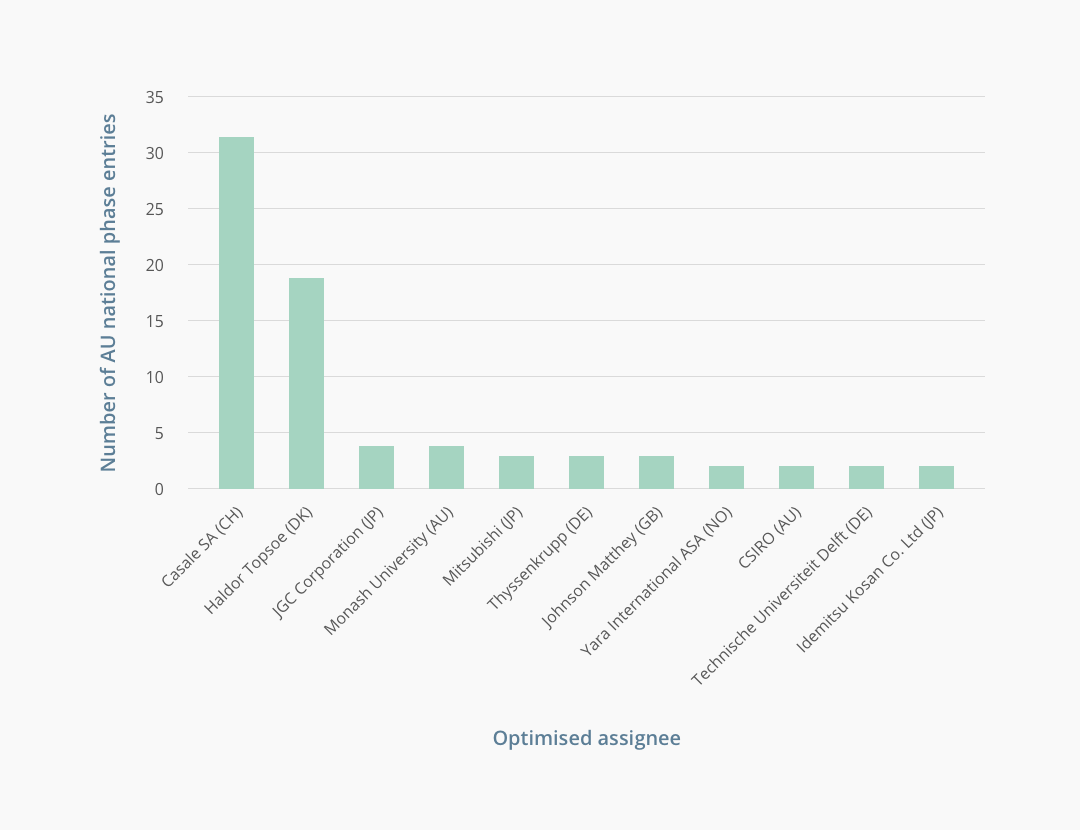

The identity of assignees with two or more Australian national phase entries (Figure 4) somewhat reflects the international application data, with both Casale SA and Haldor Topsoe A/S being the top two Australian applicants by a considerable margin. This suggests that Australia is considered a favoured destination for the top applicants in ammonia production technologies. A notable difference is that the Japanese entities and some other companies have not translated their international patent applications into Australian national phase applications. This is likely unsurprising for the Japanese research institutions that may be constrained by budget, but perhaps surprising for some of the large companies.

Apart from Monash University and the Commonwealth Scientific and Industrial Research Organisation (CSIRO), the lack of Australian entities filing patent applications suggests minimal local innovation in ammonia production. However, we might expect to see increased future local activity given the Australian government’s position that Australia could become a global producer of hydrogen and ammonia,10 and is incentivising the development of these technologies through government funding. Overall, in the future, we expect Australian patent filings to continue to increase.

Figure 4. Assignees with two or more Australian national phase entries related to ammonia production between 2010 and 2023. Entities under one parent company are combined.

Conclusion

Although ammonia is considered a possible future alternative fuel, this does not appear to have led to the same magnitude of increased patent applications as other “clean” technologies. Given ammonia production will likely increase based on its use in fertilizer manufacture and its developing use as an alternative fuel, we expect there to be an acceleration in patent applications as technology for end-use applications, like ammonia powered vehicles, mature.

However, from the present study, Australia already looks to be an attractive jurisdiction for companies wanting to protect their innovations in the ammonia production space and we expect this trend to continue in the future.

The attorneys at FPA possess a diverse range of technical expertise from engineering to industrial chemical process chemistry and are therefore able to assist in identifying and protecting innovations related to alternative fuels, such as ammonia.

1 The Guardian. Sales of electric vehicles surge as fast-charging sites double across Australia in a year

2 The Guardian. Australian electric vehicle sales in first half of 2023 already higher than all of 2022, report says

3 Global EV Outlook 2023 – Executive Summary

4 Aziz M, Wijayanta AT, Nandiyanto ABD. Ammonia as Effective Hydrogen Storage: A Review on Production, Storage and Utilization. Energies. 2020; 13(12):3062.

5 Performance Garage. Toyota Proposes End of Electric Vehicles

6 New Scientist. Look to the past for the fuel of the future

7 Soloveichik, G. New generation of fuel cells: fast, furious and flexible.

8 For a review of Ammonia production technologies see: Ghavam S, Vahdati M, Wilson IAG and Styring P (2021) Sustainable Ammonia Production Processes. Front. Energy Res. 9:580808. doi: 10.3389/fenrg.2021.580808.

9 Hughes, T.,Wilkinson, I., Tsang, E., McPherson, I., Sudmeier, T., Fellowes, J., et al. (2015). Green ammonia. Available at: http://businessdocbox.com/73271609-Green_Solutions/Green-ammonia-september-2015.html

10 Minerals Council of Australia. Australia’s Emerging Hydrogen and Ammonia Industry